Gold has been a means of survival, investment, bartering, and commerce, for humankind, extending thousands of years. Once known as the 'hobby of kings,' famous civilizations, such as the Eqyptians, thrived off of the use of gold. Not only did it make beautiful adornments for fashion, it also holds a value that has yet to see a comparable competition.

Many civilizations have developed and flourished solely based on the use of gold as the standard unit of commerce. Although some of these civilizations have crashed through history, one thing remains: gold's value has only strengthened and has made its way into modernized protection of wealth and private investments.

Gold has withstood cultural divides and language blockades, adding to its value that globally speaking, everyone understands. Golden Eagle Coins specializes in a wide variety of gold bullion coins and other gold bullion products. Our large inventory caters to both the gold bullion investor as well as the collector.

Gold Bullion Coins

- A gold bullion bar guaranteed and produced by a sovereign national mint such as the Royal Canadian Mint (RCM) will typically have a higher premium or slightly higher price when buying, but government guaranteed gold bars typically receive a higher buy back premium when you go to sell your gold bar back to gold dealers or other investors.

- We’ve made it easy to buy Gold from our selection of Gold bullion, including the right bar of Gold for your portfolio or collection. Gold Bars for Sale Gold bars come in many different shapes and sizes. You can buy Gold bars online with an assortment in fineness, typically.999 or.9999 fine.

19 to March 23, the S&P 500 lost 33.9%, and physical gold based on the London Bullion Market Association price lost 6.0%, while gold futures on the S&P GSCI Gold benchmark index ER lost.

By far, Gold Bullion Coins are the most asked about gold bullion products we sell. This is the case for numerous reasons, one being that gold coins not only contain the intrinsic value of gold but also carry the value of its weight and gold purity, which both are backed by central banks throughout the world. Another reason gold coins are so popular, among investors, is that there is rarely a shortage of production since most gold bullion coins are minted yearly and according to demand.

Why Invest In Gold Bullion Coins?

Gold coins offer a unique investment opportunity as you are not only investing in the metal itself, but also the scarcity or rarity of the coin. Many collectors will use mintage as a guide when choosing gold coins to collect. Most larger countries are modern producers of gold coins, while many countries who have been producing them for centuries. Not only do federal governments produce gold coins but there are a number of trustworthy, world renown private mints that do as well.

Gold coins are offered beyond just the 1 oz incremental size. Each gold coin carries a monetary value, depending on the nation's fiat currency, and are struck with the minimum of .999 pure gold, wherein the Canadian Gold Maple or the Australian Gold Kangaroo are .9999 pure.

Popular Gold Bullion Coins

- American Gold Eagles: The most sought after gold bullion coin, the Gold Eagles contain 22-karat gold purity and are available in a variety of sizes: 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz. As an homage to the $20 Liberty Saint-Gaudens' design, the Gold Eagles contain the same obverse design as the Pre-1933 gold relic. The reverse design is a more recent creation, first drafted by Miles Busiek in 1986, when the American Gold Eagles were first released.

- American Gold Buffalo: Another familiar design, the American Gold Buffalo design honors the 1913 nickel that was drafted by James Earle Fraser. The obverse contains a side profile portrait of a Native American Chief, while the reverse showcases the American Bison. First released in 2006, the American Gold Buffalo is one of the youngest US coin collections available. The American Gold Buffalo holds the title for first ever 24-karat gold coin, produced by the United States Mint.

- South African Kruggerand: First released in 1967, the South African Kruggerand holds the title of first gold bullion coin collection in the world. It became the exclusive vehicle of private gold ownership. In the 1980's, it's popularity took off, and the series was able to release a variety of sizes apart from the 1 oz. The obverse design features Paul Kruger, the first constitutionally elected president of South Africa. The reverse design is of South Africa's national symbol: the Springbok antelope.

- Canadian Gold Maple Leaf: One of the purest gold coins, of regular issue, in the world, the Canadian Gold Maple Leaf is produced by the renown Royal Canadian Mint. Each Gold Maple Leaf proudly carries .9999 on their reverse, indicating exactly how pure they are. The Royal Canadian Mint is a leader in coin security and production, making their Gold Maple Leaf coins impossible to counterfeit. The reverse contains a sugar maple leaf with the coin's date of mintage. The obverse contains Queen Elizabeth II's effigy, since the Royal Canadian Mint is a Crown Corporation. The Canadian Gold Maple Leaf is offered in 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and more recently, in 1/20 oz as well.

- Chinese Gold Panda: Among the few gold coin collections that change their reverse design annually, the Chinese Gold Panda series is also one of the longest running gold coin programs in the world. First minted in 1982, the Gold Panda creates a new reverse design each year that always includes a panda. The reverse showcases the famous Temple of Heaven, located in the heart of Beijing. The Chinese Gold Panda series recently changed their weights so what used to be increments of 1 oz, 1/2 oz, 1/4 oz, and 1/20 oz, are now 30 grams, 15 grams, 8 grams, 3 grams, and 1 gram.

- Pre-1933 US Gold Coins: In 1848, the Independent Treasury Act of 1848 was introduced, placing a strict money standard on business. The American Government required only gold or silver coins as a means of currency. In 1850, the $20 Liberty was first released, containing 90% gold, and became the largest gold coin to be used as money, at the time. Before that, the $10 eagles were the largest gold coin but frustrated the public since the need for more of them was apparent depending on transaction sizes. In 1907, the $20 Saint-Gaudens gold coin replaced the $20 Liberty. All gold coin production ceased in 1933, when the Gold Standard ended. Pre-1933 coins carry hefty values and have become very popular among investors, as well as collectors. Golden Eagle Coin's Pre-1933 Gold Coins inventory contains an extremely competitive variety.

- Austrian Gold Philharmonic: Minted at the historic Austrian Mint in Vienna, internationally famous for producing exceptional gold coins for more than 800 years, the Austrian Gold Philharmonic is one of the most beautiful modern gold bullion coins. Beginning in 1989, the Austrian Mint first issued their Gold Philharmonic series, in hopes of honoring the greatness that is the Vienna Philharmonic Orchestra. Designed by Thomas Pesendorfer, the Austrian Gold Philharmonics contain the same design each year and are guaranteed to be .9999 pure. The weights are offered in 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz.

- Mexican Gold Libertad: The Mexican Mint is one of the oldest mints in the Western Hemisphere and has quite the reputation among other countries. In 1921, the Mexican Mint made a gold coin called the Centenario, that represents the 100th year anniversary of Mexico's independence from Spain. A winged Victoria was featured on this coin to celebrate their victory over their captors and their well-deserved independence from the prestigious country. The Centenario was such a beloved coin that in 1981, the Mexican Mint decided to start a bullion coin series to honor it. The Mexican Gold Libertad wasn't minted regularly until 1991, making the preceding dates more difficult to find. The Mexican Gold Libertad is offered in weights of 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz.

- Australian Gold Kangaroo: Beginning in 1986, the Perth Mint released the Gold Nugget series. To join alongside the other coin series from Australia, the Perth Mint renamed the series the Australian Gold Kangaroo. Each Gold Kangaroo contains .9999 pure gold in its content. The Perth Mint also changed the design from actual gold nuggets to one of the most recognizable members of the Australian wildlife. Since the Perth Mint already began the Kookaburra series, they thought it would be a smart idea to offer other wildlife coin series and bring some much needed attention to the vast Australian outback. The Australian Gold Kangaroo features Queen Elizabeth II's updated portrait as the obverse design.

- European Gold Bullion: Ranging from English Gold Sovereigns to Swiss 20 Francs to Austrian 4 Ducats, our European Gold Bullion inventory is constantly changing and flourishing. Collectors and investors are enjoying these coins that are dated all the way back to the 15th century. Since these coins are no longer being minted, their value and demand is ever increasing. Certified versions are also available.

- Isle of Man Gold Cat: The Isle of Man Gold Cat coins were first produced in 1988, by the Pobjoy Mint. The Pobjoy Mint is located in Surrey, England and they produce non-circulating tokens, medallions, and coins for other countries. They even have stamp programs for 5 countries, including the Bahamas. The Pobjoy Mint was inspired by the small island between Great Britain and Ireland, the Isle of Man. Soon after, they learned that the Manx cat originated there and thus began their gold cat series. The Gold Cat's designs are changed annually to feature a different breed of cat. Each coin weighs 1 oz and contains 24-karat gold.

Who Mints Gold Bullion Coins?

Since Gold Bullion Coins are backed by central governments, there are numerous sovereign mints that are globally respected for their products. Some examples of these mints are:

-United States Mint: Opened their doors in 1792, as per our Founding Fathers' requests, and produced the very first American gold coin in 1795.

-Royal Canadian Mint: Founded in 1908, and released the first Canadian gold coin in 1912.

-Central Mint of China: Established in 1920, although the first gold coin in China was made around the 5th or 6th century BC.

-Perth Mint: Opened in 1899 but the first Australian gold coin was minted in 1800.

-South African Mint: The first South African gold coin was minted in 1817 and the mint opened in 1941.

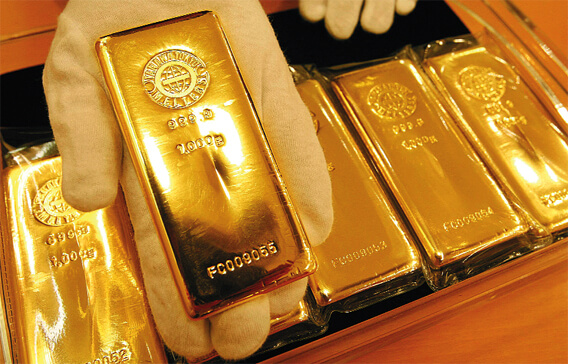

Gold Bullion Bars

As far as pricing, Gold Bullion Bars are a less expensive alternative to Gold Bullion Coins, which will carry higher premiums depending on the country of their origin. Manufacturers can come from a variety of countries, with the most popular being Switzerland, United States, Canada, and Australia. Although the refineries, that produce the Gold Bullion Bars, are not backed by the central banks or government, they usually mandate an assayer to approve of the quality, purity, and weight of each product.

Normally, Gold Bullion Bars are at least .999 fine (but oftentimes are .9999) and most reputable refineries will encase them in a certificate card with a matching serial number on the bar. These certificates will also contain the weight and purity as well. Gold Bullion Bars are offered in a wider variety of sizes than the coins, ranging from 1 gram to a 5 oz bar and beyond.

Popular Gold Bullion Bars

-Random Manufacturer: Gold Bullion Bars, produced at the most admirable private refineries, offered for the lowest premium.

-Pamp Suisse Fortuna Bars: Known worldwide for its assortment of bar sizes (1 oz and 100 gram Hand Poured are the most popular).

-Perth Mint Bars: The bars contain no design and come in airtight assay card.

-Valcambi Gold Bars: 50 gram CombiBar is a creative way to obtain 50 grams of gold through 1 gram detachable bars.

-Credit Suisse Bars: Produced at one of the world's oldest refineries and comes secured in airtight assay card.

-Sunshine Mint: Investors enjoy their 1 oz bars the most.

Purchasing Gold Bullion From Golden Eagle Coins

Purchasing gold for investment purposes has traditionally been a hedge against inflation and weakness in the US dollar. For thousands of years, gold has been a store of wealth and value which continues today. Owning physical precious metals is a strategy of the very wealthy for centuries and although precious metals don't necessarily need to be your only investment, it may be wise to make them a part of your strategy moving forward.

Offering our customers competitive prices and a wide range of inventory, while also providing a positive purchasing experience, is our top priority. We appreciate honest reviews and are available through our call center or email address, if you have any questions or concerns.

Gold Bullion Coins

By far, Gold Bullion Coins are the most asked about gold bullion products we sell. This is the case for numerous reasons, one being that gold coins not only contain the intrinsic value of gold but also carry the value of its weight and gold purity, which both are backed by central banks throughout the world. Another reason gold coins are so popular, among investors, is that there is rarely a shortage of production since most gold bullion coins are minted yearly and according to demand.

Why Invest In Gold Bullion Coins?

Gold coins offer a unique investment opportunity as you are not only investing in the metal itself, but also the scarcity or rarity of the coin. Many collectors will use mintage as a guide when choosing gold coins to collect. Most larger countries are modern producers of gold coins, while many countries who have been producing them for centuries. Not only do federal governments produce gold coins but there are a number of trustworthy, world renown private mints that do as well.

Gold coins are offered beyond just the 1 oz incremental size. Each gold coin carries a monetary value, depending on the nation's fiat currency, and are struck with the minimum of .999 pure gold, wherein the Canadian Gold Maple or the Australian Gold Kangaroo are .9999 pure.

Popular Gold Bullion Coins

- American Gold Eagles: The most sought after gold bullion coin, the Gold Eagles contain 22-karat gold purity and are available in a variety of sizes: 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz. As an homage to the $20 Liberty Saint-Gaudens' design, the Gold Eagles contain the same obverse design as the Pre-1933 gold relic. The reverse design is a more recent creation, first drafted by Miles Busiek in 1986, when the American Gold Eagles were first released.

- American Gold Buffalo: Another familiar design, the American Gold Buffalo design honors the 1913 nickel that was drafted by James Earle Fraser. The obverse contains a side profile portrait of a Native American Chief, while the reverse showcases the American Bison. First released in 2006, the American Gold Buffalo is one of the youngest US coin collections available. The American Gold Buffalo holds the title for first ever 24-karat gold coin, produced by the United States Mint.

- South African Kruggerand: First released in 1967, the South African Kruggerand holds the title of first gold bullion coin collection in the world. It became the exclusive vehicle of private gold ownership. In the 1980's, it's popularity took off, and the series was able to release a variety of sizes apart from the 1 oz. The obverse design features Paul Kruger, the first constitutionally elected president of South Africa. The reverse design is of South Africa's national symbol: the Springbok antelope.

- Canadian Gold Maple Leaf: One of the purest gold coins, of regular issue, in the world, the Canadian Gold Maple Leaf is produced by the renown Royal Canadian Mint. Each Gold Maple Leaf proudly carries .9999 on their reverse, indicating exactly how pure they are. The Royal Canadian Mint is a leader in coin security and production, making their Gold Maple Leaf coins impossible to counterfeit. The reverse contains a sugar maple leaf with the coin's date of mintage. The obverse contains Queen Elizabeth II's effigy, since the Royal Canadian Mint is a Crown Corporation. The Canadian Gold Maple Leaf is offered in 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and more recently, in 1/20 oz as well.

- Chinese Gold Panda: Among the few gold coin collections that change their reverse design annually, the Chinese Gold Panda series is also one of the longest running gold coin programs in the world. First minted in 1982, the Gold Panda creates a new reverse design each year that always includes a panda. The reverse showcases the famous Temple of Heaven, located in the heart of Beijing. The Chinese Gold Panda series recently changed their weights so what used to be increments of 1 oz, 1/2 oz, 1/4 oz, and 1/20 oz, are now 30 grams, 15 grams, 8 grams, 3 grams, and 1 gram.

- Pre-1933 US Gold Coins: In 1848, the Independent Treasury Act of 1848 was introduced, placing a strict money standard on business. The American Government required only gold or silver coins as a means of currency. In 1850, the $20 Liberty was first released, containing 90% gold, and became the largest gold coin to be used as money, at the time. Before that, the $10 eagles were the largest gold coin but frustrated the public since the need for more of them was apparent depending on transaction sizes. In 1907, the $20 Saint-Gaudens gold coin replaced the $20 Liberty. All gold coin production ceased in 1933, when the Gold Standard ended. Pre-1933 coins carry hefty values and have become very popular among investors, as well as collectors. Golden Eagle Coin's Pre-1933 Gold Coins inventory contains an extremely competitive variety.

- Austrian Gold Philharmonic: Minted at the historic Austrian Mint in Vienna, internationally famous for producing exceptional gold coins for more than 800 years, the Austrian Gold Philharmonic is one of the most beautiful modern gold bullion coins. Beginning in 1989, the Austrian Mint first issued their Gold Philharmonic series, in hopes of honoring the greatness that is the Vienna Philharmonic Orchestra. Designed by Thomas Pesendorfer, the Austrian Gold Philharmonics contain the same design each year and are guaranteed to be .9999 pure. The weights are offered in 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz.

- Mexican Gold Libertad: The Mexican Mint is one of the oldest mints in the Western Hemisphere and has quite the reputation among other countries. In 1921, the Mexican Mint made a gold coin called the Centenario, that represents the 100th year anniversary of Mexico's independence from Spain. A winged Victoria was featured on this coin to celebrate their victory over their captors and their well-deserved independence from the prestigious country. The Centenario was such a beloved coin that in 1981, the Mexican Mint decided to start a bullion coin series to honor it. The Mexican Gold Libertad wasn't minted regularly until 1991, making the preceding dates more difficult to find. The Mexican Gold Libertad is offered in weights of 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz.

- Australian Gold Kangaroo: Beginning in 1986, the Perth Mint released the Gold Nugget series. To join alongside the other coin series from Australia, the Perth Mint renamed the series the Australian Gold Kangaroo. Each Gold Kangaroo contains .9999 pure gold in its content. The Perth Mint also changed the design from actual gold nuggets to one of the most recognizable members of the Australian wildlife. Since the Perth Mint already began the Kookaburra series, they thought it would be a smart idea to offer other wildlife coin series and bring some much needed attention to the vast Australian outback. The Australian Gold Kangaroo features Queen Elizabeth II's updated portrait as the obverse design.

- European Gold Bullion: Ranging from English Gold Sovereigns to Swiss 20 Francs to Austrian 4 Ducats, our European Gold Bullion inventory is constantly changing and flourishing. Collectors and investors are enjoying these coins that are dated all the way back to the 15th century. Since these coins are no longer being minted, their value and demand is ever increasing. Certified versions are also available.

- Isle of Man Gold Cat: The Isle of Man Gold Cat coins were first produced in 1988, by the Pobjoy Mint. The Pobjoy Mint is located in Surrey, England and they produce non-circulating tokens, medallions, and coins for other countries. They even have stamp programs for 5 countries, including the Bahamas. The Pobjoy Mint was inspired by the small island between Great Britain and Ireland, the Isle of Man. Soon after, they learned that the Manx cat originated there and thus began their gold cat series. The Gold Cat's designs are changed annually to feature a different breed of cat. Each coin weighs 1 oz and contains 24-karat gold.

Who Mints Gold Bullion Coins?

Since Gold Bullion Coins are backed by central governments, there are numerous sovereign mints that are globally respected for their products. Some examples of these mints are:

-United States Mint: Opened their doors in 1792, as per our Founding Fathers' requests, and produced the very first American gold coin in 1795.

-Royal Canadian Mint: Founded in 1908, and released the first Canadian gold coin in 1912.

-Central Mint of China: Established in 1920, although the first gold coin in China was made around the 5th or 6th century BC.

-Perth Mint: Opened in 1899 but the first Australian gold coin was minted in 1800.

-South African Mint: The first South African gold coin was minted in 1817 and the mint opened in 1941.

Gold Bullion Bars

As far as pricing, Gold Bullion Bars are a less expensive alternative to Gold Bullion Coins, which will carry higher premiums depending on the country of their origin. Manufacturers can come from a variety of countries, with the most popular being Switzerland, United States, Canada, and Australia. Although the refineries, that produce the Gold Bullion Bars, are not backed by the central banks or government, they usually mandate an assayer to approve of the quality, purity, and weight of each product.

Normally, Gold Bullion Bars are at least .999 fine (but oftentimes are .9999) and most reputable refineries will encase them in a certificate card with a matching serial number on the bar. These certificates will also contain the weight and purity as well. Gold Bullion Bars are offered in a wider variety of sizes than the coins, ranging from 1 gram to a 5 oz bar and beyond.

Popular Gold Bullion Bars

-Random Manufacturer: Gold Bullion Bars, produced at the most admirable private refineries, offered for the lowest premium.

-Pamp Suisse Fortuna Bars: Known worldwide for its assortment of bar sizes (1 oz and 100 gram Hand Poured are the most popular).

-Perth Mint Bars: The bars contain no design and come in airtight assay card.

-Valcambi Gold Bars: 50 gram CombiBar is a creative way to obtain 50 grams of gold through 1 gram detachable bars.

-Credit Suisse Bars: Produced at one of the world's oldest refineries and comes secured in airtight assay card.

-Sunshine Mint: Investors enjoy their 1 oz bars the most.

Purchasing Gold Bullion From Golden Eagle Coins

Purchasing gold for investment purposes has traditionally been a hedge against inflation and weakness in the US dollar. For thousands of years, gold has been a store of wealth and value which continues today. Owning physical precious metals is a strategy of the very wealthy for centuries and although precious metals don't necessarily need to be your only investment, it may be wise to make them a part of your strategy moving forward.

Offering our customers competitive prices and a wide range of inventory, while also providing a positive purchasing experience, is our top priority. We appreciate honest reviews and are available through our call center or email address, if you have any questions or concerns.

Buy Gold Bullion Fallout 76

- American Gold EaglesUncirculated 1986-Date

- American Gold Buffalo CoinsBU & Proof

- South African Gold Krugerrands

- Canadian Gold Maple Leafs1979-Date

- Gold Bars1 Gram to Kilo

- Gold CoinsPopular Bullion Coins

- Pre-1933 US GoldExtra Fine, AU, BU

- European Gold BullionSovereigns, 20 Francs, Ducats

- Austrian Philharmonic Gold Coins

- Chinese Gold Pandas

- Mexican Gold Coins

- British Royal Mint Britannias & Sovereigns2014 & Prior

- British Royal Mint Queen's Beast Gold Coins

- Modern Gold Commemoratives$5 & $10

- US Mint Centennial Gold Coin Series

- First Spouse Series GoldProof & Uncirculated

- Australian Gold Lunar Series 1

- Australian Gold Lunar Series 2

- Australian Gold Lunar Series III

- Australian Gold & Perth Mint

- Isle Of Man Gold Cats

- Royal Canadian Mint Products

- Gibraltar Gold Dogs

- Singapore Gold Coins

- Gold Chinese Coins(Fans, Flowers, Lunar, etc.)

- Angel Gold CoinsAssorted Countries

- World Gold Coins

- Other Gold Products

Are you searching for reviews for the best place to buy gold online or the top gold coin and gold bullion websites?

Every day, thousands of people search to “buy gold online”.

And there are so many places to buy gold coins and gold bullion online – which gold websites can you trust?!

Many gold coin websites are legit, others are not.

We’ve compiled the ultimate list of top websites that sell gold coins online (and gold bullion).

What You Need to Know About Buying Gold Coins Online

The gold and silver market have taken off in a big way these last few years, with a faster-paced society and a more interconnected world economy, economic stability is more susceptible than ever to outside influences. A strike in China can influence the dollar, for example, and political instability in Europe affects the course of our economy.

The value of the dollar rises because people believe the US is doing great, regardless whether that is true or not. It is a matter of faith and trust.

An investment in Gold, however, maintains an intrinsic value that is not so closely tied to the actions or economic policies of a government. A gold coin today is worth its weight and holds its value better than many other commodities.

Gold bullion is popular among those in the know.

Aside from the relatively stable value of bullion over paper currency and other commodities, why do people invest in precious metals and coins?

- Internationally recognized value: gold is gold and has the same price anywhere in the world.If the market crashes, the stock is worthless. Bullion, however, can save you.In the blink of an eye, paper currency can lose its value. The same cannot be said of metal though. No matter the country you may be in, a golden dollar can be bartered with. People may not even know what a dollar is, but they understand gold.

- Survivability: in case of a crisis or war, you can always count on gold to remain intact. It does not tarnish or deteriorate, unlike paper, which can burn, tear, or decompose. A gold hoard buried 5000 years ago can still be found and maintain value. The trick is not to lose track of it!

- Transportability: gold and bullion are valuable even in small quantities. An ounce of gold can buy you a vacation and it can be hidden in your pocket.

The Top 10 Websites to Buy Gold Bullion & Gold Coins Online

So how do you go about getting your gold and bullion in the 21st century?

The internet provides a fast and effective way to safely buy gold bullion.

Quality and security are imperative, so here is an overview of the top ten best places to buy gold online:

#1 Money Metals Exchange

Money Metals Exchange review: Founded in 2010, MoneyMetals.com has quickly risen to prominence not only as a seller but also as an educator for numismatic aficionados. With over 75,000 buyers and more than half a million readers and subscribers, they’re a serious dealer and influencer in the world of numismatics, providing quality at affordable prices making a big niche in the online gold market.

The gold coins that you buy from MoneyMetals.com will reflect and remain close to their original melt price. Note that this is unlike other numismatics dealers that tend to exaggerate the extrinsic value of their coins.

Learn more: https://www.moneymetals.com

#2 Buy Gold and Silver Coins

Buy Gold and Silver Coins review: This is a big player in the coin business. It is one of the largest bulk coin and bullion dealers in the US. An A+ rated business by BBB, this is a reliable business partner.

They maintain a large stock, and ship and deliver on time. You’ll be pleased to hear that they pride themselves on their reliability and honesty. And you can rest assured that they go the extra mile by insuring all their packages before sending you your gold.

Learn more: https://bgasc.com

#3 JM Bullion

JM Bullion review: This Texan dealer is known for its no-nonsense approach to selling bullion. Located in Dallas, jmbullion.com has risen quickly through the ranks to become a big favorite amongst investors and buyers alike.

They hold a lot of stock and they ship on time. Security is always a concern with this kind of transaction, especially over the internet, and this company knows it. They will see to it that everything goes smoothly. With them, you are assured to be holding your bullion in your personal vault at the end of the transaction.

Learn more: http://Jmbullion.com

Buy Gold Bullion Fo76

#4 Bullion Vault

Bullion Vault review: The world’s largest online investment gold service, bullionvault.com needs no introduction to any investor that has ever dealt in bullion. They offer a quick and easy platform for investors to peruse the professional bullion market and provide cut-rate prices on buying, selling, and storing of bullion, be it gold or silver.

Possessing vaults in London, Zurich, and Singapore, amongst others, this is a big player running some 2 billion dollars’ worth of bullion for 70,000 investors. These serious investors flock to them due to the low insurance and storage cost of their precious metals.

Learn more: https://www.bullionvault.com

#5 SD Bullion

SD Bullion review: This is another newcomer to the market. The firm was founded in 2011 by two doctors who wanted to educate people on the value of silver.

The company they created has quickly risen to be regarded as a serious player. Their motto is: «nothing fancy, just a telephone call and low prices.”

Indeed, the doctors are true to their word. They’ve already shipped over 300,000 orders. In a relatively short time, they have even managed to appear on “Hit Inc. Magazine’s” list of the 500 fastest-growing companies. Twice!

They guarantee the lowest possible prices on gold and silver bullion. And they also buy from private individuals at a competitive price.

Add to that a serious interest in educating the masses on the fundamentals of gold and silver investment, and you can begin to understand their ever-growing popularity.

Learn more: https://sdbullion.com

#6 GoldSilver

GoldSiver review: Here you will find another site that prides itself on its role as an educator.

Goldsilver.com was founded by renowned precious metal advisor Mike Maloney. His bestselling book remains one of the best publications on precious metals investment. This is a real professional that takes the time to analyze the minutiae of the market.

The site offers customers a dedicated team of professionals that will look after their interests, informing and advising on current market trends and projections.

This team of online gold dealers invest heavily in research, which is why many professionals seek their services when they look for an advantage in the market.

Learn more at: http://goldsilver.com

#7 Monex Precious Metals

Monex Precious Metals review: Monex an old player, monex.com has been at it for fifty years, and they are still looking strong. They specialize in buying and selling bullion and precious metals.

Their best qualities are that they are dependable and trustworthy. Offering their customers relevant market information, they strive to create long-term relationships with savvy investors. This is why their traders take the time and effort to educate and inform their customers.

Learn more at: https://www.monex.com

#8 Golden Eagle Coins

Gold Eagle Coins review: Another old-timer going strong, goldeneaglecoin.com specializes in selling gold and silver coins, especially dollars.

Though they also sell bullion and precious metals, they like to keep abreast of new developments. Their site offers a constant update on prices and global developments.

If you are looking for a reliable and trusty partner that has stood the test of time, you could do a lot worse than checking out this Washington DC giant.

Learn more at: https://www.goldeneaglecoin.com

#9 Schiff Gold

Schiff Gold review: This is an online gold bullion and gold coin player that merges low prices with quality service, the specialists and professionals at schiffgold.com take the time to educate and advise all-comers. The online gold dealer is a favorite with investors because of its affiliate with economist and influencer Pete Schiff. The site’s experts sell and buy precious metals, offering a guarantee on price and purity of every product sold. In addition to this common practice, however, they offer a personalized relationship with investors. It is this difference that has earned them such a great following and why they definitely make our list of one of the top ten places to buy or sell gold online.

Learn more: https://schiffgold.com

#10 Metals.com

Metals.com review: This market leader prides itself on customer involvement and service. There’s little doubt that they are focused on going the extra mile to ensure customer satisfaction.

That being said, they also offer very competitive prices in the precious metal market, so potential customers don’t need to worry about trading quality service for quality products. With metals.com, you can have them both.

In addition, the site provides guaranteed authenticity and shipping to put their customers’ minds at rest.

Now You Are Ready to Buy Gold Online

Whichever website you choose to buy gold online, the main things to consider are their guarantees, independence, security, and stability. Though these are difficult to attain investing in precious metals, at times, bullion and coins is a good way to go to hedge your bets and provide a financial plan B in case things go sour.

Precious metals may not offer the glossy and high profits that other trendy branches of the market offer for a short while, but they do offer certainty. Investors who made it before the Internet bubble burst may feel very good about themselves, while those who didn’t should pay extra careful attention to these words.

That is the true value that comes from precious metals. Just as with land, more of it is not being made, which is why the prices tend to rise and will continue to do so. Gold offers you one of the safest forms of investment in today’s and tomorrow’s market. And these ten online gold dealers offer you ideal ways to begin or grow your investments.

If you like this post, you might also want to check out our list of best websites to buy men’s pre-owned luxury watches online.